Insurance policy for temporarily non-marketable risks (short term, 2 years)

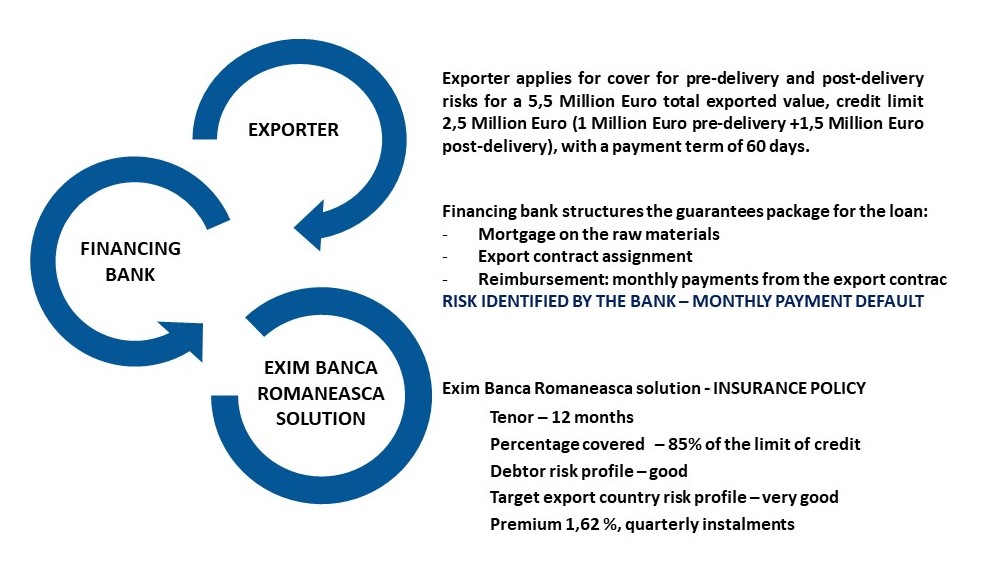

Exim Banca Romaneasca covers maximum 85% of the losses registered by the Romanian exporter due to the occurrence of some commercial and political risks on the market of European Union and of OECD countries. This facility falls within the category of state aids and is authorized by European Commission.

Until December 31st, 2026, Exim Banca Romaneasca can cover the short-term risks incurred by the small, medium sized and large enterprises, irrespective of their export turnover volume, the number of external partners they want to insure, for the risk period (which includes the manufacturing period and the reimbursement period) of up to two years.

To benefit of this facility, the exporters should have commercial exchanges and/or a favorable history of payments (in case there is already a commercial relationship), and the buyers should have a positive history as regards the compensations, an acceptable payment default probability and also an acceptable internal and/or external financial rating .

At the same time, the exporters should provide proofs that two private insurers of export credits refused to cover the risk.

The waiting period, respectively the period between the occurrence date of the insured risk and the date the exporter is entitled to request the compensation payment, is of 90 days.

Characteristics

- insurance period: maximum 2 years,

- currency: RON or foreign currency, according to the export contract.

Exim Banca Romaneasca takes over the risks associated to export credits conducted by member countries of EU and OECD in case there is a lack of insurances on the market for the following situations:

- deliveries made by SMEs with an annual turnover from exports below EUR 2.5 million, with payment deadlines up to 2 years;

- deliveries to a single debtor, or contracts with a single debtor, with payment terms longer than 181 days and shorter than 2 years.

Covered risks

- Commercial risks:

- arbitrary termination of a contract by a private debtor, respectively any arbitrary decision to interrupt or suspend the contract;

- insolvency of the private debtor or of its guarantor;

- extended payment default by a private debtor and by its guarantor of a debt;

- Political risks:

-

- the risk that a public debtor does not pay in time;

- the risk that a public debtor or a country prevents the achievement of an export transaction;

- risks exceeding the will of individual buyers or which are not the responsibility of individual buyers;

- the risk that a country does not transfer or does not allow the transfer in the insured’s country of the amounts paid by the debtors located in that country;

- the risk of a force majeure case occurrence outside the insured’s country, which could include events such as wars, to the extent they are not insured in another way.

-

Costs:

| Debtor’s risk category | Total annual premium |

| Excellent | 0.51% – 1.299% |

| Good | 0.825% – 2.049% |

| Satisfying | 1.575% – 4.149% |

| Poor | 3.675% – 7.449% |

Beneficiaries

- SMEs with an annual export turnover lower than EUR 2.5 million;

- exporters (SMEs and large companies) making deliveries to a single debtor, in case the period of risk exposure (manufacturing period plus period of commercial credit) is longer than 181 days, but not exceeding 2 years.

Advantages

- no guarantees are required to issue the policy,

- the policy can be used as collateral to finance the exports contract execution.